System and data analytics are necessary in numerous industries to manage the cash flows and performance of any medium-large and international business. All of them exist to make a profit as a result of their activity. Though there are many economic factors that affect business success, systems and data analytics are the main drivers of economic benefits.

Power BI implementation helps to see the weak and strong points, profits and plans, effectiveness of branches and shops, team performance, and many other important factors and indicators for crucial decision-making.

Use Power BI consulting for better system and metrics reporting implementation.

What is Business Intelligence?

To make the data and financial processes parsing faster and efficient companies really need business analytics insurance BI systems in their business processes to automate the control and activity management.

The Power Business Intelligence platform is designed to fit the needs of different users. It’s flexible enough for finance teams to run predictive insights and set goals, operations managers to monitor productivity KPIs, sales managers to track team performance, and executives to see high-level metrics and gain a holistic view of the company.

Business Intelligence for insurance companies

Business Intelligence for insurance companies

The company we will describe is under an NDA agreement, but without providing the name, it is one of the insurance industry representatives. They applied to Cobit Solutions in 2021 with a global demand to rebuild their system of managing reports into Power BI, an effective insurance business intelligence software.

The matter was that the old reporting system was too hard and time-consuming, using endless sheets of Excel. We had to make a consulting stage and a complex rebuilding of the reporting approach and existing system of individual calculations of financial results.

Key metrics dashboard

Our client had a purpose to see the tendencies and influence on daily business and forget about hard making and time-consuming sheets of Excel.

Time Saving Report of KPIs

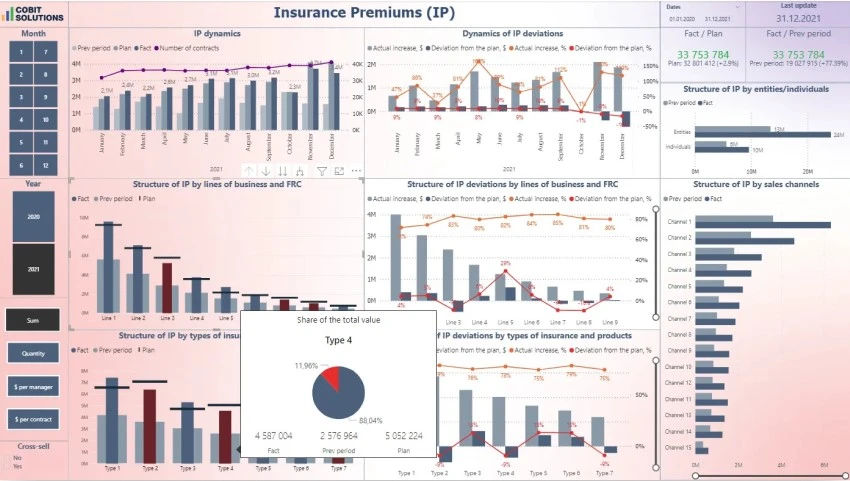

The Key Metrics dashboard here reflected the most important KPIs to see on a daily basis.

Prompt premiums daily reporting

Another vital task was to track the daily premiums and process of insurance payment. We implemented prompt daily reporting on accrued and paid insurance premiums.

IT equipment management analytics

As an additional bonus, the operational department received data-based decision making for risks. New tools and business intelligence for insurance systems help company employees not only to see their specialized dashboards each time when they access the cloud solution, but to organize and research their own results reflected in accordance with one another.

What we have started with

The process began with the client’s demand clearance with the number of meetings of our consultants and department managers. After the Power BI consulting we provided the company determined the most important indicators with critical meaning of the working system of the divisions and teams.

The IT department gave its special request including IT assets inventory dashboard, health insurance, etc. This stage included the consulting of the accounting systems for future BI for insurance integration and important results to reflect for the client and forget about time consuming Excel tables deprived of any adjusting or daily performance.

Dashboards IT structure got categories and indicators to analyze. According to the priority of dashboards types, we have developed the first financial data BI insurance dashboards.

Steps for implementing business intelligence in an insurance company

Firstly we have created a technical architecture diagram of the business analytics system. As the second step laid out the future road map for the business intelligence in insurance development for the next 2 years in the company.

After these actions our specialist started the sketching dashboards for the creation of BI for CFO and other users with the agreed charts displaying key performances.

Difficulty of business intelligence implementing in a company

It is worth mentioning that the task was not just to imply BI for insurance analytics with balance sheet dashboards, but to make a complex rebuilding of the reporting approach. Cobit Solution’s Analytics BI team started automation of the reporting system to save time and increase the business control of the customer.

The system of management was specified for the individual calculations of financial results according to the company’s mechanisms after consulting . We have automated the processes and launched power BI integration in the insurance industry. After the development and launch, the new system has imported data from different sources, due to the existing accounting policy, in the form of algorithms.

After visualization of the automated processes, Cobit Solutions specialists performed data integrity checks together with the client’s staff. The company shifted from the old way of reporting into power BI analytics turning Excel tables into comprehensible and appealing dashboards.

CEO insurance dashboards

New tools and reporting management systems help company employees not only to see their specialized dashboards each time when they access the cloud solution, but to organize and research their own results reflected in accordance with one another.

Insurance data analytics security

Innovative dashboard development services guarantee data security (2FA authentication) and confidentiality, providing access to business intelligence insurance dashboards from any device anytime the users need.

Results and benefits of Power BI implementation

We have developed and launched dashboards and planned the list of others under development according to an early developed strategy.

Results of Power BI implementation

The key feature of the business intelligence for insurance project became full management system rebuilding to leave Excel reports in the past and maximize auto processing. It also became a benefit and an option for the future risk management in the insurance industry. As an additional plus, the operational department got data-based decision making for risks. Financial analysis BI insurance dashboards calculate and reflect the tendencies, including future risks, using Microsoft Power BI Platform.

Benefits of Power BI implementation

Great benefits that the insurance company got from the new management system balance sheet KPI dashboards was worldwide access because of the cloud BI technology. Innovative business intelligence in insurance industry guarantee data security (2FA authentication) and confidentiality, providing access to dashboards from any device anytime the users need.

A new system of reporting helps to manage the risks and provide the insurance services, consulting and forecast.

Advantages of insurance business intelligence solutions

As an additional bonus, the operational department received data-based decision making for risks. New tools and business intelligence for insurance systems help company employees not only to see their specialized dashboards each time when they access the cloud solution, but to organize and research their own results reflected in accordance with one another.

Reporting system of management rebuilding

Custom specialized BI and analytics dashboards

Handy management and search of the reported data

Conclusions

To sum up our fruitful collaboration took 1.5 years for the full system rebuilding, handy management, and search of the reported data implementation. The company got specialized dashboards for insurance premiums, paid insurance premiums and a complex of financial results dashboards for this period. Besides the adjustments of the data synchronization modules and launch the insurance company got from the new management system balance sheet KPI dashboards. It is highly beneficial for them due to the worldwide access which cloud Power BI technology offers.

Take control of your workflows today with Cobit Solutions!

To get the reporting system and enhance the control over your business apply to Cobit Solutions specialists.