System and data analytics is necessary in numerous industries to manage the cash flows and performance of any medium-large and international business. All of them exist to make profit as the result of their activity. Though there are many economic factors that affect business success, system and data analytics are main points for the economic benefits.

To make the data and financial processes parsing faster and efficient companies really need business analytics insurance BI systems in their business processes to automate the control and activity management. Power BI implementation helps to see the weak and strong points, profits and plans, effectiveness of branches and shops, team performance and many other important factors and indicators for crucial decision making.

Business Intelligence for insurance companies

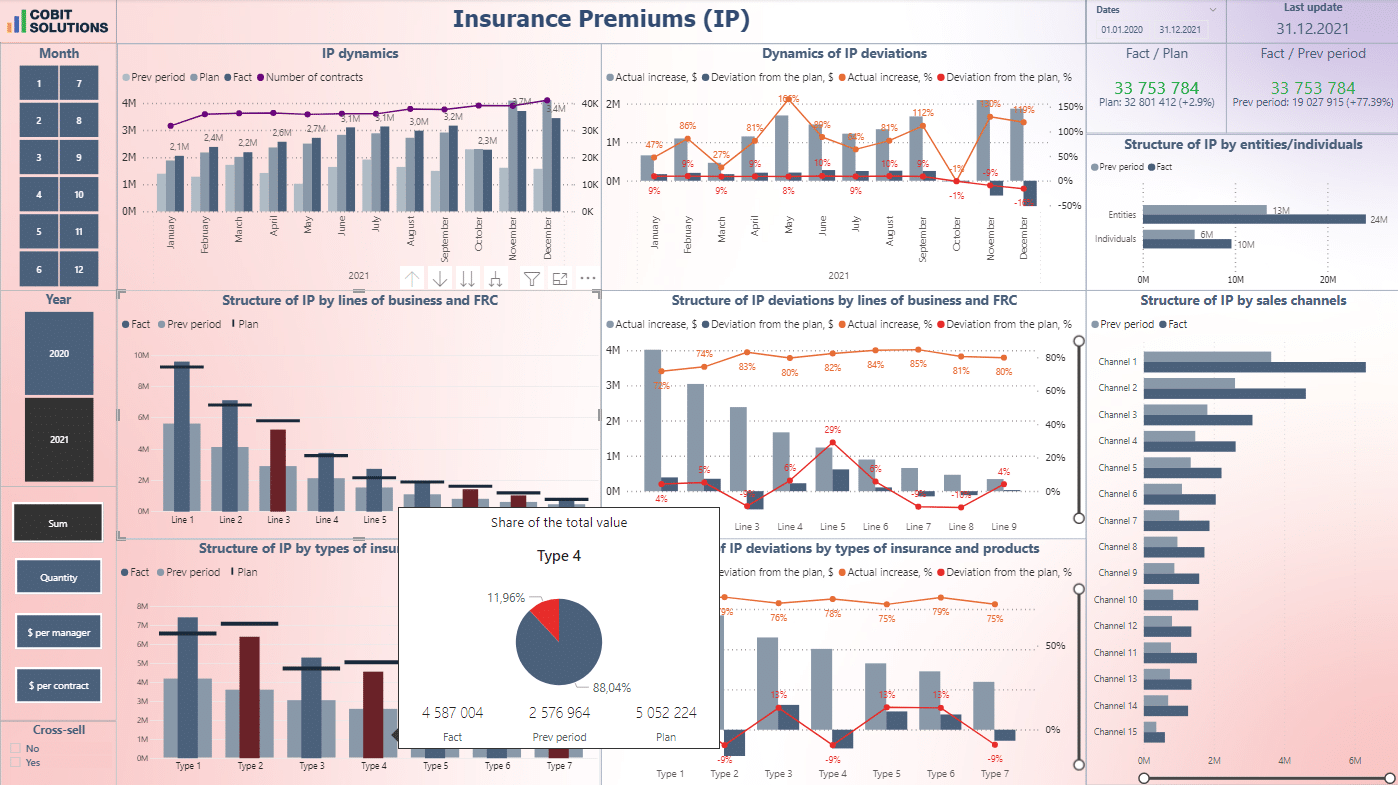

The company we will describe is under an NDA agreement, but without providing the name, it is one of the insurance industry representatives. They have applied to Cobit Solutions in 2021 with a global demand to rebuild their system of managing reports into the Power BI effective insurance business intelligence software.

Our client had a purpose to see the tendencies and influence on daily business and forget about hard making and time-consuming sheets of Excel.

What we have started with

The process began with the client’s demand clearance with the number of meetings of our consultants and department managers. The company determined the most important indicators with critical meaning of the working system of the divisions and teams. The IT department gave its special request including IT assets inventory dashboard, health insurance, etc.

This stage included the selection of the accounting systems for future BI for insurance integration and important results to reflect for the client and forget about time consuming Excel tables deprived of any adjusting or daily performance. Dashboards IT structure got categories and indicators to analyze. According to the priority of dashboards types, we have developed the first financial data BI insurance dashboards.

- Firstly we have created a technical architecture diagram of the business analytics system. As the second step laid out the future road map for the business intelligence in insurance development for the next 2 years in the company.

- After these actions our specialist started the sketching dashboards for the creation of BI for CFO and other users with the agreed charts displaying key performances.

- This way the new reporting system of BI insurance management was formed with a number of unique insurance dashboards tailored for each department, set users and sources of information.

Want to order interactive dashboards?

Get a commercial offer

It is worth mentioning that the task was not just to imply BI for insurance analytics with balance sheet dashboards, but to make a complex rebuilding of the reporting approach. Cobit Solution’s Analytics BI team started automation of the reporting system to save time and increase the business control of the customer.

The system of management was specified for the individual calculations of financial results according to the company’s mechanisms. We have automated the processes and launched power BI integration in the insurance industry. After the development and launch, the new system has imported data from different sources, due to the existing accounting policy, in the form of algorithms.

After visualization of the automated processes, Cobit Solutions specialists performed data integrity checks together with the client’s staff. The company shifted from the old way of reporting into power BI analytics turning Excel tables into comprehensible and appealing dashboards.

CEO insurance dashboards

New tools and reporting management systems help company employees not only to see their specialized dashboards each time when they access the cloud solution, but to organize and research their own results reflected in accordance with one another.

Insurance data analytics & security

Innovative dashboard development services guarantee data security (2FA authentication) and confidentiality, providing access to business intelligence insurance dashboards from any device anytime the users need.

Results and benefits of Power BI implementation

During the 1.5 years of our collaboration we have developed and launched dashboards for insurance premiums, paid insurance premiums and a complex of financial results dashboards. The list of other departments plans is under development according to an early developed strategy. The development stage moves on to the necessary adjustments of the data synchronization modules and launch. The additional benefits that the insurance company got from the new management system balance sheet KPI dashboards was worldwide access because of the cloud BI technology. Innovative business intelligence in insurance industry guarantee data security (2FA authentication) and confidentiality, providing access to dashboards from any device anytime the users need.

The key feature of the business intelligence for insurance project became full management system rebuilding to leave Excel reports in the past and maximize auto processing. It also became a benefit and an option for the future risk management in the insurance industry. As an additional plus, the operational department got data-based decision making for risks. Financial analysis BI insurance dashboards calculate and reflect the tendencies, including future risks, using Microsoft Power BI Platform.

A new system of reporting helps to manage the risks and provide the insurance services and forecast. It enhances the control over the situation in business.

Advantages of insurance business intelligence solutions

As an additional bonus, the operational department received data-based decision making for risks. New tools and business intelligence for insurance systems help company employees not only to see their specialized dashboards each time when they access the cloud solution, but to organize and research their own results reflected in accordance with one another.